what is suta taxable wages

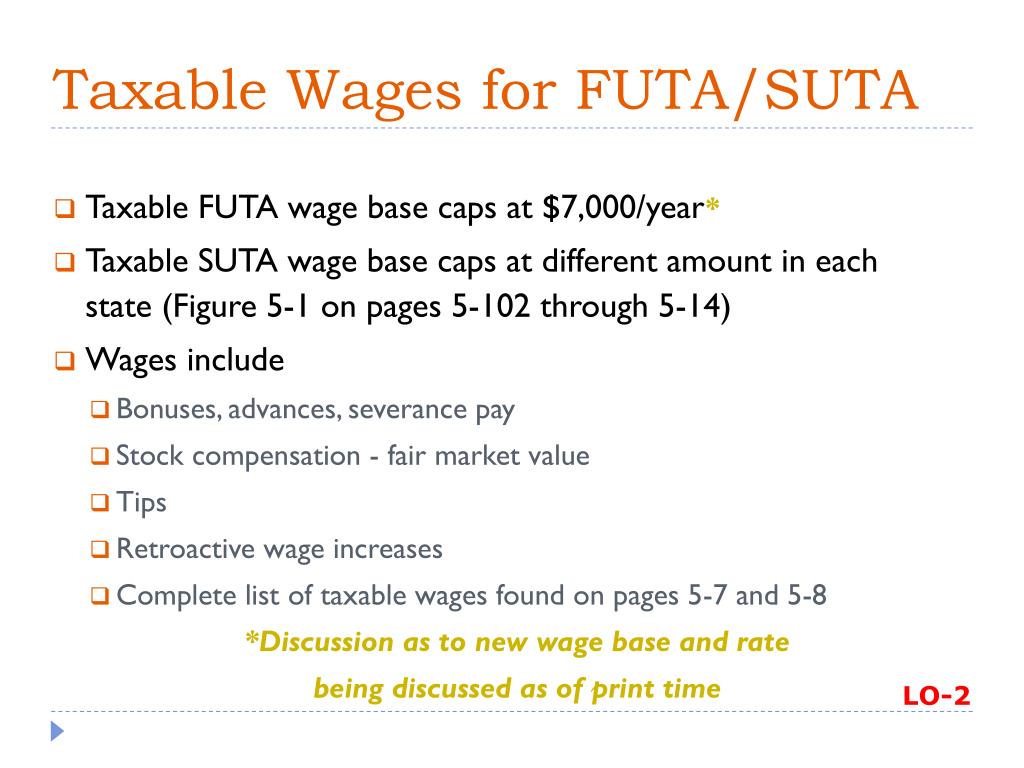

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. The standard FUTA rate in 2022 is 6 with a taxable wage base of 7000 per employee or taxable wages up to 7000.

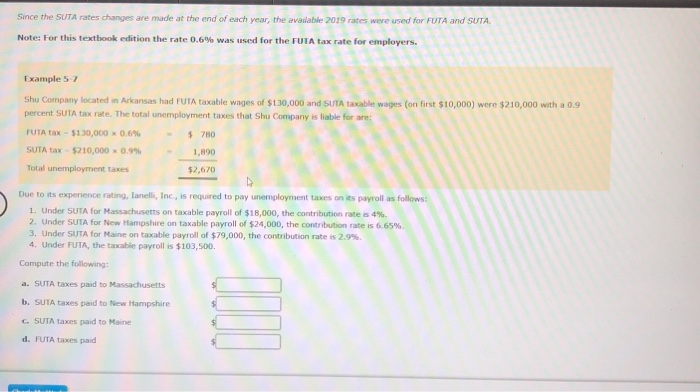

Solved Since The Suta Rates Changes Are Made At The End Of Chegg Com

Ideally the unemployment tax is calculated on taxable wages that fall under the first 7000 per employee per year limit.

. In the first a new company buys an existing company to obtain its. Assume that your company receives a good assessment and your SUTA tax. The employer will no longer pay UI taxes on this individual for the remainder of the year.

Tax rate for new employers. You may receive a credit. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

Select the Tax Sheltered Annuities check box. This means that an employers federal. It serves the same purpose as the SUTAcollecting taxes from employers for the purposes of providing unemployment benefits.

Wages are reported when they are paid rather than when they are earned or accrued. That means you dont pay the tax on any. Select the TSA deduction that the SUTA or.

However certain types of. Employers report employee gross wages each quarter and pay taxes on the first 9000 per employee per. Heres how an employer in Texas would calculate SUTA.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Taxable wage base. The amount that can be taxed is an.

For example a new employer in Kentucky running a non-construction business would need to pay up to 28350 in SUTA taxes per employee in 2019. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. However the employer will.

In Florida in particular the taxable wage base is among the. Tax rate for experienced employers. SUTA and FUTA may seem similar but they have vastly different applications.

The wage base is the maximum amount of an employees gross income that can be used to calculate SUTA tax. Taxable wages or Personal Income Tax PIT wages are cash and non-cash payments that are subject to local state and federal withholding tax. Heres everything you need to know about how these two taxes differ.

Generally all wages paid to an Employee are reportable for Federal and State Unemployment Insurance FUTA and SUTA in order for applicable taxes to be paid. Any amounts exceeding 7000 are tax-exempt. New York State Department of Labor.

SUTA and FUTA tax rates Each state has its own SUTA tax rates ranging from 065 to 68 The wage base limit or the maximum threshold for which the SUTA taxes can. Annual Taxable Wages SUTA Wages up to state limit per employee SUTA Liability SUTA wages SUTA rate Barry 28000 7000 Jordan 50000 7000 Total 78000 14000. Your states wage base.

In the Unemployment Tax Setup window type the two-digit tax code in the Tax Code field. 1 Employee A has reached the UI taxable wage limit of 7000 for the year.

Suta State Unemployment Taxable Wage Bases Aps Payroll

Fast Unemployment Cost Facts For Washington First Nonprofit Companies

Strong And Equitable Unemployment Insurance Systems Require Broadening The Ui Tax Base Economic Policy Institute

Unemployment Insurance Taxes Iowa Workforce Development

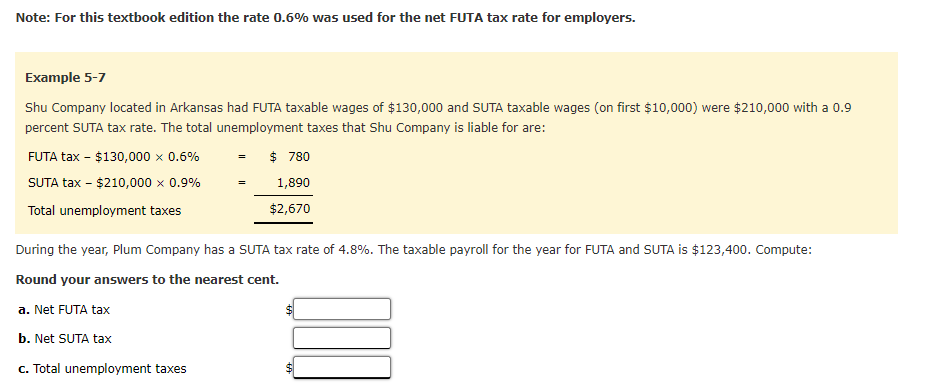

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Solved Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S

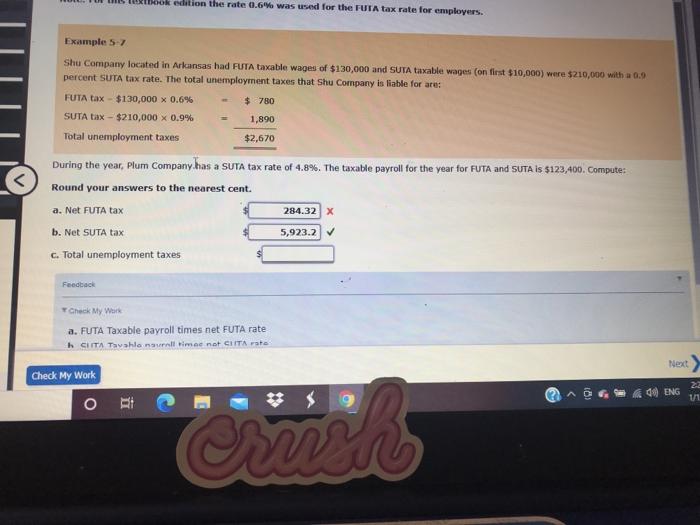

Solved Ook Edition The Rate 0 6 Was Used For The Futa Tax Chegg Com

How To Pay State Unemployment Tax Suta Businessnewsdaily Com

State Unemployment Tax Act Suta Bamboohr

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

Ppt Chapter 5 Powerpoint Presentation Free Download Id 5767532

How To Fill Out Form 940 For Federal Unemployment Taxes

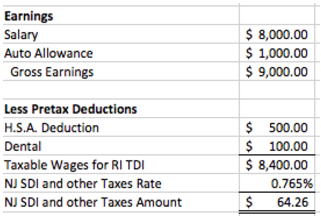

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Suta Wages Taxes Microsoft Dynamics Gp Forum Community Forum